Hey there!

Curious about CFI courses and certifications but feeling a bit unsure if they're the right fit for you? Totally get it—I've been there too.

But no need to stress.

In this in-depth review of Corporate Finance Institute (CFI), we're diving into the good stuff, possible downsides, pricing details, how effective the courses are, the certifications offered, perks of membership, and more. Plus, I'll throw in some of my own experiences with CFI.

Hopefully, by the end, you'll have a clearer picture to decide if CFI is the perfect match for you.

Let's get started!

Is CFI Legit?

I can confidently say that Corporate Finance Institute (CFI) is a legitimate platform for learning and advancing your skills in finance. As someone who has explored their offerings, I found CFI to be a trustworthy source for financial education.

The platform is well-established, with a solid reputation in the industry. They provide valuable content, expert guidance, and a structured learning environment, making it a credible choice for those looking to enhance their knowledge in corporate finance.

Pros and Cons of Corporate Finance Institute

1 Valuable Certifications: CFI certifications, particularly the FMVA, are recognized in the finance industry. 2 High-quality Coursework: Delivers in-depth course content that is relevant to finance industry standards. 3 Expert-Led Learning: CFI courses are taught by knowledgeable professionals with industry level experience. 4 Comprehensive Curriculum: Offers a complete learning package covering a variety of finance topics. 5 Online Community: Allows us to interact with the CFI instructors and fellow learners. 1 Time commitment: Takes a lot of time (3-6 months) and effort to complete a certification program.Pros

Cons

In my thorough review of CFI, I've identified several pros and cons to help you make an informed decision. On the positive side, CFI offers comprehensive courses, practical insights, and a user-friendly platform.

However, it's essential to note that some courses might be more challenging for beginners, and the pricing could be a consideration for budget-conscious learners.

Overall, the advantages outweigh the drawbacks, making CFI a beneficial resource for individuals seeking quality financial education.

CFI Course Effectiveness

Having delved into various courses on CFI, I can attest to the effectiveness of their content. The courses are well-structured, covering a wide range of topics in corporate finance.

The combination of video lectures, interactive quizzes, and practical exercises enhances the learning experience.

The real-world applications provided in the courses contribute to practical skill development, making CFI an effective platform for acquiring and applying financial knowledge.

Are CFI Certifications Worth It?

CFI offers certifications that hold value in the finance industry. Earning a certification from CFI demonstrates your commitment to professional development and mastery of essential financial concepts.

These certifications can enhance your resume and credibility in the job market. While they come at a cost, the investment is worthwhile for those seeking recognition and validation of their expertise in corporate finance.

1. Financial Modeling & Valuation Analyst (FMVA) Certification

This is CFI’s most popular and oldest certification program that was launched back in 2017. But since then, it has only garnered

If you want to become a financial analyst, then this FMVA certification program will be very useful for you to develop relevant skills.

Tim Vipond, Scott Powell, Duncan McKeen and Jeff Schmidt are the instructors for this FMVA program. They have done a fantastic job here. Every concept was explained crystal clear.

You need to complete 17 courses and final exam to earn your FMVA certification. There are 14 core courses and 19 elective courses. You need to complete all the core courses and 3 courses from the electives. There are more than 200+ exercises and it was actually more engaging.

Pro Tip: Don’t miss the Amazon case study in electives. It was fun and full of insights.

It might take around 3 to 6 months to complete this certification program successfully. It’ll change based on your time availability.

One fourth of the CFI FMVA certification program content is focussed on financial modeling.

You’ll learn how to:

- Build and analyze financial models for various purposes like company valuation.

- Communicate financial information effectively and professionally.

- Make informed investment decisions based on financial analysis and valuation techniques.

- Use advanced financial modeling techniques such as discounted cash flow (DCF) analysis.

You’ll also learn about financial statements, different valuation methodologies, forecasting techniques, advanced data visualization techniques and more.

2. Commercial Banking & Credit Analyst (CBCA) Certification

This program focusses more on financial analysis and credit structuring.

You have to complete 19 courses and pass the final exam to get your CBCA certification from CFI.

You can make use of the 12 optional prep courses to learn about the credit and lending basics. You’ll know everything about credit analysis and loan underwriting after completing the 16 core courses.

You need to complete all the core courses and 3 out of the 25 elective courses. I chose Asset-Based Lending & Alternative Finance, Lending to Complex Structures and Syndicated Lending in the electives to learn about the lending concepts.

The 6 case study challenges in the CFI’s CBCA certification program was also extremely useful to understand how things work in the real world.

This program will help you develop the skills you need to become a credit analyst, commercial banker, private lender, etc.

3. Capital Markets & Securities Analyst (CMSA) Certification

You need to complete the 8 core courses and a minimum of 7 out of 25 elective courses to earn your CMSA certification.

More than 50% of the content is about derivatives and fixed income.

By the end of the program, you’ll know how derivatives work. You’ll also learn about equity markets, fixed income markets, foreign exchange markets and analytical methodologies.

There are optional case study challenges in this CFI certification program. You can also use that to get a better understanding of some technical analysis tools and how options traders construct trading strategies.

You’ll see many instructors in this program like Tim Vipond, Andrew Loo, Guy O’Loughnane, Meeyeon Park, Paul North and Scott Powell. It’s a good sign because we’ll be learning various topics from experts with actual industry knowledge in their domain.

This program will help you in acquiring the skills to get into asset management, wealth management, risk management, sales and trading careers.

4. Business Intelligence & Data Analyst (BIDA) Certification

CFI’s BIDA certification courses is all about data transformation, data visualization and data modelling.

And you’ll learn some basic coding stuff with a focus on python and SQL.

Throughout the program, you’ll also get to learn a lot about popular business intelligence tools like Microsoft Power BI, Tableau, Excel and more.

The course about each tool comes with a detailed case study to help you practice what you learn.

All the courses in this program are focused primarily on popular BI tools, but I’d love to see them add content to learn about fast growing BI tools like Qlik.

CFI brings in BI & Data experts to deliver this program. You’ll learn from Sebastian Taylor who has more than 10 years of experience in business intelligence and data analysis, Joseph Yeates, Pavel Nacev and many others.

To earn your BIDA certification, you need to complete all the 15 required courses and attain the minimum passing grade of 70% in your final exam.

This certification program is for you if you’re looking to gain relevant skills to become a BI developer, business analyst, data analyst, etc.

5. Financial Planning & Wealth Management Professional (FPWM) Certification

The Financial Planning & Wealth Management Professional (FPWM) certification was launched by CFI in the year 2022.

If you’re ultimate goal is to become a investment advisor or financial planner, then CFI’s FPWM certification program can help you in gaining relevant skills.

In the 12 core courses of this program, you’ll learn everything from 7-step financial planning process to portfolio management and insurance planning.

The FPWM program covers a comprehensive range of topics, enabling us to:

- Gain a thorough understanding of financial planning principles and processes.

- Master various investment management strategies and asset allocation techniques.

- Develop expertise in risk management.

- Build and manage a successful wealth management practice.

- Build strong client relationships.

- Stay updated with the latest trends and regulations in the financial planning industry.

In addition to the core courses, you have to complete a minimum of 4 elective courses to get your FPWM certification.

There are more than 80 interactive exercises in this program. So we have an opportunity to learn by performing tasks that’ll be similar to real-world scenarios.

6. FinTech Industry Professional (FTIP) Certification

Considering the significant growth of the FinTech industry, CFI recently came up with this FTIP certification program. It is designed by experts in a way to help us keep up with the fast changes in this growing field.

FinTech Industry Professional (FTIP) certification program will be extremely useful in acquiring the necessary fintech skills to start your career in this sector.

Across the 23 courses in this program, there are more than 70 hours of learning content and 160+ interactive exercises.

However, to get your CFI FTIP certification, you just need to complete the 13 required courses.

Completing the prep courses, 10 core courses plus 3 out of 4 elective courses is enough to take the final exam.

The FTIP program will be equipping you with the skills and knowledge to:

- Understand the core principles and key drivers of the FinTech revolution.

- Analyze the impact of FinTech on various financial sectors like banking, insurance, etc.

- Explore cutting-edge technologies like blockchain and its applications in FinTech.

The optional practice labs in this program will be helpful to learn about NFT minting, building Robo-Advisor and InsurTech Pricer.

CFI Specializations

CFI provides specializations that allow learners to focus on specific areas within corporate finance.

Whether it's financial modeling, valuation, or other specialized topics, these programs enable you to deepen your expertise in a particular area.

The specializations are designed to cater to diverse career paths, making CFI a versatile platform for professionals looking to specialize in specific domains of corporate finance.

CFI Free Courses

One noteworthy aspect of CFI is its offering of free courses. These courses serve as an excellent introduction to their teaching style and content quality.

While the free courses may not cover advanced topics, they provide valuable insights for beginners and offer a glimpse into what CFI has to offer.

It's a commendable approach, allowing learners to assess the platform before committing to paid courses.

Are CFI Instructors Credible?

CFI boasts a team of experienced and knowledgeable instructors. Having reviewed their credentials and learning from their content, I can affirm the credibility of CFI's instructors.

Their expertise in the field of corporate finance is evident in the way they present complex concepts in a clear and understandable manner. The diverse backgrounds of the instructors contribute to a well-rounded learning experience for students.

CFI Members Community

Joining the CFI community provides learners with opportunities to connect, collaborate, and share experiences with fellow finance enthusiasts. The community aspect fosters a supportive environment for learning and networking.

Whether you're seeking advice, sharing insights, or simply engaging in discussions, the CFI community adds a valuable social dimension to the learning journey.

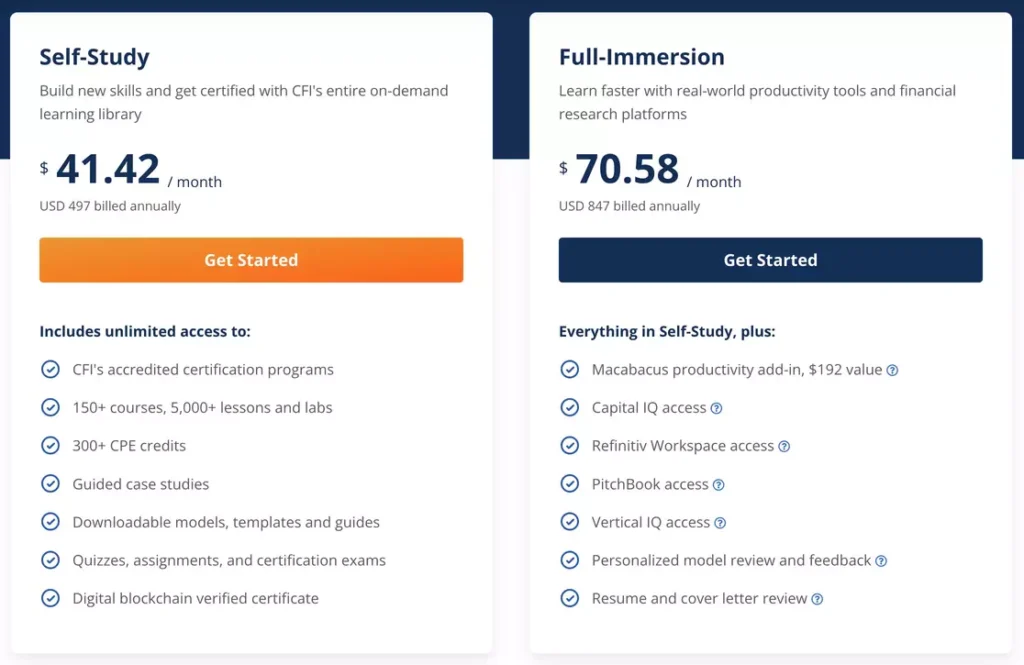

CFI Pricing and Plans

CFI Plans for Individuals

CFI offers two membership plans for individuals.

The Self-Study plan costs $597 per year. This is a good option if you’re comfortable learning on your own.

The Full-Immersion plan costs $847 per year and it comes with a lot of additional benefits such as expert guidance and premium career resources.

Both the plans will give you full access to CFI’s on-demand learning library. So you’ll get access to 180+ courses, 6 certifications, and 8 specialization programs. However, there are some key differences between the two plans.

The CFI Full-Immersion plan includes everything in the Self-Study plan, plus:

- Fin chatbot: AI guidance and support in 25+ languages for all CFI courses.

- One-on-one guidance: Get curriculum questions answered by CFI instructors (5 per week).

- Model Feedback: Get your financial models reviewed by experts (1 per week).

- Resume Boost: Get your resume/CV and cover letter reviewed monthly.

- Premium Toolbox: Access 100s of premium templates, guides, and cheat-sheets to work smarter.

- Exclusive Deals: Get discounts and free access to top tools like Macabacus, Capital IQ, Refinitiv, FinChat and Vertical IQ.

Think about what you need and how much you’re willing to pay, then compare the CFI plans to find the best fit.

Single Program Subscription

Besides these membership plans, CFI also introduced single program subscription model in 2024.

So you also have an option to enroll in a single CFI certification ($497/yr) or CFI specialisation ($297/yr) program.

You can go with this option if you just want to take any one program (like FMVA) in CFI.

But I would recommend you to opt for a membership plan instead of purchasing a single program.

CFI Plans for Teams

CFI offers two main pricing plans for teams: Basic and Premium.

The Basic plan will cost $399 per learner annually. You can get access to 180+ on-demand courses with 5,000+ video lessons. You can set up learning paths for your team members or use the role-based learning paths provided by the experts.

The Premium plan provides unlimited access to all the CFI certifications, courses and specialization programs. You’ll get everything from the basic plan plus additional benefits like dedicated account manager, blockchain-verified course completion certificates, etc. This CFI premium plan (for teams) will cost $497 per learner.

Go with the Basic plan if your team just wants CFI’s courses for online learning to upgrade the skills. If there’s a need for personalized guidance from CFI experts, premium plan would be better.

Ultimately, the best CFI plan for your team will depend on your specific needs and budget.

CFI’s Refund Criteria

CFI has a transparent refund policy, and it's crucial to understand the criteria for requesting a refund. Generally, refunds are granted within a specified period after enrollment, and the conditions vary based on the type of course or program. Reviewing the refund policy ensures that learners are aware of their options and can make informed decisions about their commitment to a particular course.

CFI Platform UI

The user interface (UI) of the CFI platform is intuitive and user-friendly. Navigating through courses, accessing resources, and tracking progress is straightforward. The platform's design enhances the overall learning experience, allowing learners to focus on the content without unnecessary complexities. The organized layout contributes to a seamless educational journey for users.

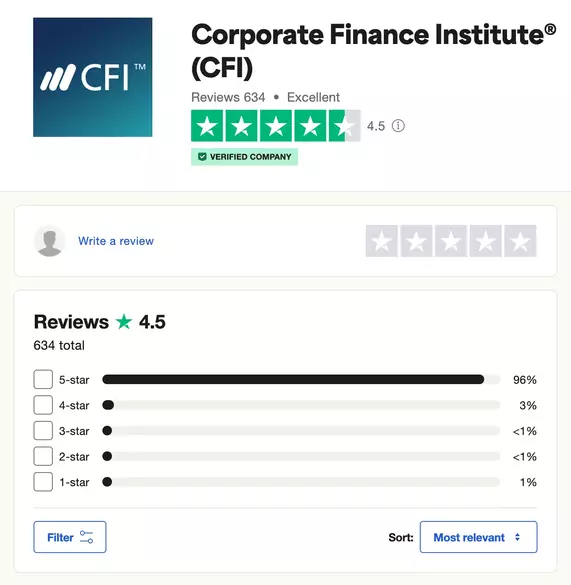

Corporate Finance Institute Reviews from Real Learners

To provide a comprehensive perspective, I've gathered insights from real learners who have experienced CFI courses. The majority of reviews highlight the platform's effectiveness, quality content, and practical relevance.

Learners appreciate the clear explanations, real-world examples, and the applicability of the knowledge gained.

While some mention the challenge of certain courses, the overall sentiment is positive, reinforcing CFI's reputation as a reliable educational platform.

CFI Review: Final Verdict (My Opinion)

After thoroughly exploring Corporate Finance Institute, I can confidently state that it is a valuable resource for individuals seeking to enhance their knowledge in corporate finance.

The platform offers a diverse range of courses, credible certifications, and a supportive community.

While pricing may be a consideration for some, the quality of content and the potential for professional growth make CFI a worthwhile investment.

My personal experience with CFI has been positive, and I believe it is a reputable choice for those looking to excel in the field of corporate finance.

FAQ’s about Corporate Finance Institute (CFI)

Are CFI certifications recognized in the industry?

Yes, CFI certifications are well-regarded in the finance industry and can enhance your professional credibility.

Do CFI courses cater to beginners?

While some courses may be challenging for beginners, CFI offers a range of programs suitable for learners at different levels.

How does CFI's refund policy work?

CFI has a transparent refund policy, and eligibility criteria vary based on the course or program. It's important to review the specific terms before enrolling.

Is the CFI community beneficial for networking?

Yes, joining the CFI community provides opportunities for networking, collaboration, and sharing experiences with fellow learners.

Are there any free resources available on CFI?

Yes, CFI offers free courses that serve as an introduction to their teaching style and content.